If you are a keen crypto enthusiast, you may be

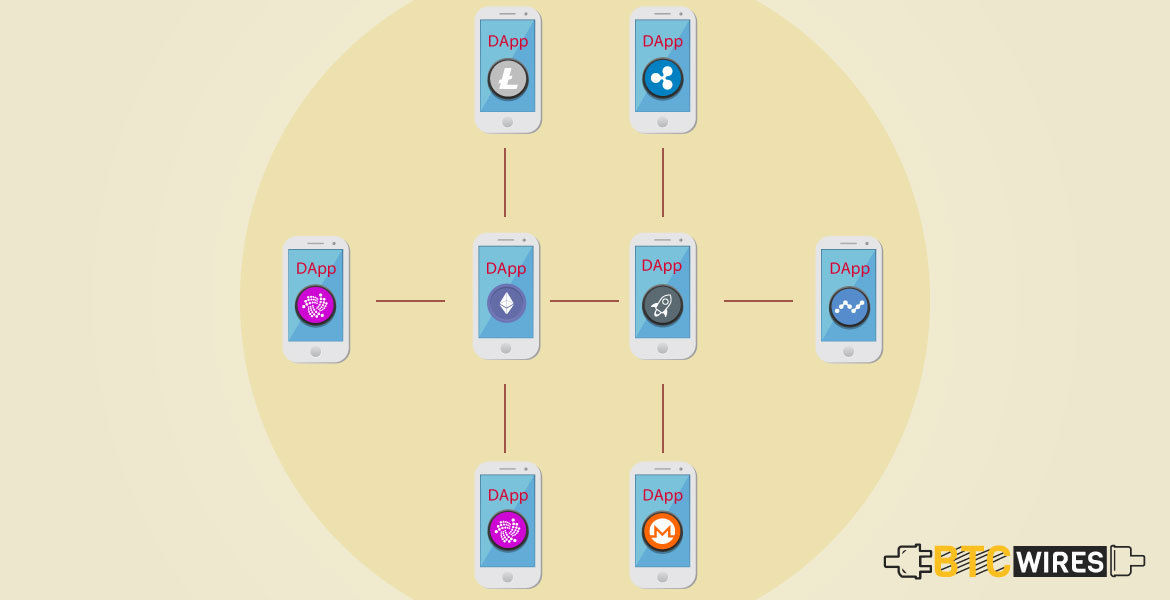

If you are a keen crypto enthusiast, you may be familiar with terms like DApps. It the common consensus now that DApps has taken the world by storm and is the future of investing in crypto.

DApps which are based on the blockchain technology is shut down proof, do not have any downtime and are not owned by anyone. Even dApp developers who create decentralized apps do not own it nor can they shut it down.

You May Also Read: A Beginner’s Guide to DApps

Difference with regular app

The obvious point of difference is the lack of ownership or not being able to shut down, even temporarily for maintenance. These apps are also decentralized and built using open source codes and also have a built-in cryptocurrency incentive.

This makes them self fuelling, and they also have an embedded mechanism that generates digital coins. DApps cost to use and are though many regular apps can’t, they can store value.

Generating Profit

Developers of dApps must ensure that the open platform that they build their applications on, will also offer a service that potential users will find worthwhile and attractive. This is done by the developers by either going down the proof-of-work route or the proof-of-stake one.

The first method is, for example, the one that is used by bitcoin. It encourages people from all around the globe to mine blocks of its coin from the limited supply that is waiting to be found.

The second method, the proof of stake one, is used by people once they have some cryptocurrency to stake. What this means is that you do not use your cryptocurrency for a period of time to allow it to grow in value on its own while also receiving a fixed amount in that same digital currency. The benefits to staking are that you do not need to mine and also that when you reinvest your rewards you are taking advantage of the power of compound interest.

You May Also Read: 5 Best & Popular dApps You Can Use in 2019

White Paper + ICOs = Crowdfunding Riches

Once a solid proof-of-work and/or a proof-of-work scheme in place, the dApp developer can start attracting investors to his platform through the publishing of a white paper and the subsequent Initial Coin Offering (ICO). Many dApp developers have made amazing crowd fund profits through their white papers and ICOs.

Transaction Fees

If you are well versed in the language of cryptocurrency investment, you already must have a fair idea about the fees that you have to pay each time you sell, buy, or move your digital currencies. dApp developers earn a very healthy income by charging transaction fees to those using your open platform.

Conclusion

Candy Crush, a free to play game, at the height of its success in 2013, had generated more than $1.5 billion. This I reflective of the revenue that can be generated from following the same profit plan on these dApps, which makes investing in cryptocurrency a lot easier too.

Here Are A Few Articles For You To Read Next: