Anyone who is the part of cryptocurrency world must have

Anyone who is the part of cryptocurrency world must have come across Binance many a time. Binance is the most popular cryptocurrency trading platforms. Today, Binance Coin has become one of the reasons why you should invest in cryptocurreny. The Binance Coin, also known as BNB token, is the platform’s cryptocurrency. It was a significant part of providing funding for Binance through the ICO, and it currently serves a lot of important functions. The Binance Coin keeps to the ERC20 token standard and natively runs on Ethereum blockchain.

Some Must-Know Things About Binance

Before you get a detailed view of the BNB token, you need to have a basic understanding of the Binance platform. In case you don’t, you need to know that it’s one of the most popular of all cryptocurrency exchanges. Though the exchange is comparatively young in the domain, yet it already has a positive reputation and is very popular.

Keeping up with the growing demand, Binance is capable of processing as much as 1.4 million orders every second and has support for about all devices including a web platform. This high processing rate is owing to the proprietary trading engine of Binance that resolves the problem of other exchanges not capable of keeping up with the growing demand. Also, Binance stands out from the competition with its low trading fees and high liquidity even without getting the discount for using BNB into the account.

BNB Burning – What’s This Term?

The programs for buying back the tokens and burning them is one of the key parts of BNB token. It’s the process that is outlined in the Binance white paper. For those who simply want a quick summary, Binance will use 20% of the profits from every quarter for buying back and then burn BNB. It has been noted that it Binance will continue this process until the supply of BNB reaches 50% of the original amount, with 100 million BNB remaining. All buyback transactions conducted by Binance to burn BNB will be declared through the blockchain for transparency.

Binance, in every quarter, will use 20% of its profits to buy back BNB tokens and destroy them, until it buys 50% of all the BNB back. Every buyback transaction will be declared through the blockchain. Binance will ultimately destroy 100MM BNB, leaving the remaining of 100MM BNB.

The most recent BNB burning took place on April 15, 2018, with the burning of 2,220,314 BNB. The next one will most probably be about the same time in July. However, the idea behind burning BNB token is very strategic. By decreasing the number of tokens in circulation, the overall value of existing tokens goes up assuming the demand remains the same. Their value can go up to a greater degree as the demand increases, which is expected to happen because of the popularity and growth of Binance.

Does The BNB Burning Affect Price of Binance Coin?

Well, the theory behind the token burning is the one thing, since most people just want proof that this really works. If you check a BNB price chart carefully to the times before, amid and after a burn, you will see the positive effects, to some extent at least. The price leads to increase dramatically right before the burn, and then decline a bit right after the burn. However, this post-burn decline is yet well above the value of the token before the pre-burn rally.

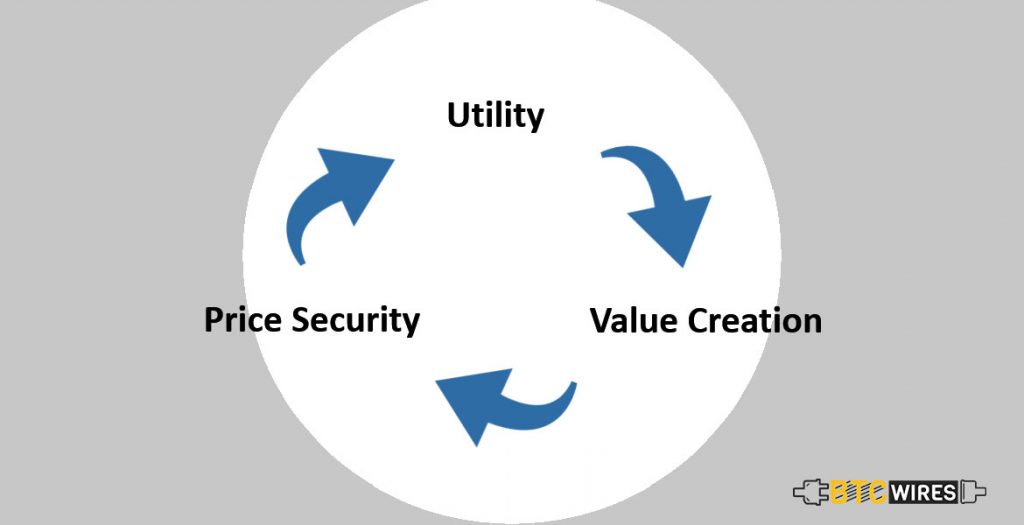

BNB Serves Certain Functions

One of the most important functions of BNB is being the underlying gas to power the entire ecosystem. Users of the exchange platform can pay their trading fees using Binance Coin, and amid the first year of implementation, this comes even with a 50% discount on trades.

Thanks to the partnerships that Binance Coin now comes with additional functionality in other ecosystems. For instance, Monaco supports BNB token on its platform, and that is what makes it possible to use Binance Coin with the Monaco Visa Card or Monaco mobile application. Also, the Uplive platform has special support for BNB as a way to buy virtual gifts from.

What Type of Discount Do You Get for Paying Binance Fees with BNB?

As with any other crypto trading platform, Binance makes some of its profit through fees collection. You can use Binance Coin to pay any of these fees, including exchange and listing fees. During the initial year of BNB deployment, paying the fees with Binance Coin gives you a 50% discount as mentioned previously. Though the discount goes down, yet it remains in place for multiple years, providing continued savings through BNB token ownership. In the next year, the discount becomes half to 25%, halving again to 12.5% in the third year and then dropping to 6.75% in the fourth year. In the 5th year, there remains no discount, but the convenience of paying fees with Binance Coin remains the same.

If you wish to get the discount, what you need to do is to keep Binance Coin in your exchange wallet. The discount will automatically be applied with a suitable number of tokens deducted. Also, there is the option of turning off this feature which automatically uses your Binance Coin to pay for fees in case you prefer to keep your Binance Coins. The Binance Coin is an ERC-20 token, meaning that you can also withdraw it from the exchange and then store it on your Ethereum wallet.

What is Binance Chain, and What Role Does Binance Play in It?

Undoubtedly, Binance has some plans to develop a new exchange which is decentralized, that is Binance Chain. This exchange will utilize BNB token to power it, which need to increase the coin’s demand as well as the value. Binance Chain will be a public blockchain focusing on trading as well as transferring blockchain assets.

Wrap Up!

Binance Coin, or BNB, is the token of the popular cryptocurrency exchange Binance. The main function of this exchange is to pay fees and use it in such a way that results in a discount on exchange fees. Also, the BNB token serves other purposes and will be important to the planned Binance Chain launch. Do check our guide to Top 5 cryptocurrency to invest in 2018!