Crypto points systems have evolved from the traditional airdrop, creating a new "PointFi" economy that rewards sustained user engagement.

Introduction: The Evolution from Airdrop to Points Meta

The landscape of user acquisition and community building in the cryptocurrency space has undergone a profound transformation. In the early days, projects frequently relied on a marketing strategy known as an airdrop, which involved distributing free tokens to a community to bootstrap adoption, decentralize governance, and reward early contributors.While this approach proved effective in generating initial buzz, it quickly revealed a series of systemic flaws. The primary issue was the rise of "airdrop hunters" or "farmers"—speculators who would perform minimal actions to qualify for an airdrop and then immediately sell the tokens upon receipt, creating immense "sell pressure" on the new asset.This practice led to rapid and significant drops in token value and distorted the project's metrics, ultimately undermining its long-term viability and the loyalty of genuine users.

In response to these challenges, a new and more sophisticated incentive model has emerged: the points system. This approach, adapted from time-tested marketing strategies found in Web2 loyalty programs, is designed to encourage sustained engagement over a longer period.Instead of issuing a tradable token with immediate value, projects grant users digital points as a form of "IOU" for future rewards. This strategic delay allows a project to bootstrap its network and gather valuable data on user behavior while avoiding the premature market volatility that an immediate token launch would cause.The points are meant to act as a crucial bridge, a non-liquid asset that incentivizes early users and gives the project time to establish "sufficient network value" before a full Token Generation Event (TGE).

The consequence of this evolution is a new and dynamic sub-economy known as "PointFi" or the "Point Economy".In this ecosystem, points themselves have become the product, leading to a new layer of speculation where market participants trade on the anticipated value of a future token conversion. This phenomenon has created a complex web of incentives and behaviors, forcing both projects and users to navigate a landscape where the promise of a reward is often as valuable as the reward itself.The emergence of PointFi represents a fundamental shift from the blunt, one-time rewards of early airdrops to a more continuous and data-driven approach to community engagement.

II. The Mechanics of the Points System: A Tale of Two Models

At its core, a crypto points system is a structured mechanism for assigning value to specific actions or behaviors within a community or platform.These digital assets are issued by a project to reward users for activities such as providing liquidity, staking tokens, or engaging with a decentralized application (dApp).A crucial distinction is that crypto points are not cryptocurrencies; they lack a monetary value, cannot be traded on open markets, and are typically recorded off-chain.Their perceived value is derived solely from the project's promise of a future redemption, such as a conversion to a native token, discounts, or exclusive benefits.

The vast majority of current points programs operate in an off-chain model. In this setup, a specific Web3 project or platform is responsible for disseminating and tracking the points in a centralized manner.The primary advantage of this approach is its operational efficiency: transactions are faster, cheaper, and more scalable because they do not require network consensus or gas fees.This model also gives project founders immense flexibility to adjust the rules, issue boost multipliers, and retroactively determine the final token allocation based on user behavior data.

However, this prevalent off-chain model presents a fundamental paradox within the Web3 ethos. While the core promise of cryptocurrency is to remove the need for centralized trust and intermediaries through transparent, decentralized technology, the points systems used to build many of these communities are opaque and centralized.The total supply of points, the distribution logic, and the final conversion rate can be a "black box," requiring users to place a level of trust in the project's founders that the underlying blockchain technology was designed to eliminate.

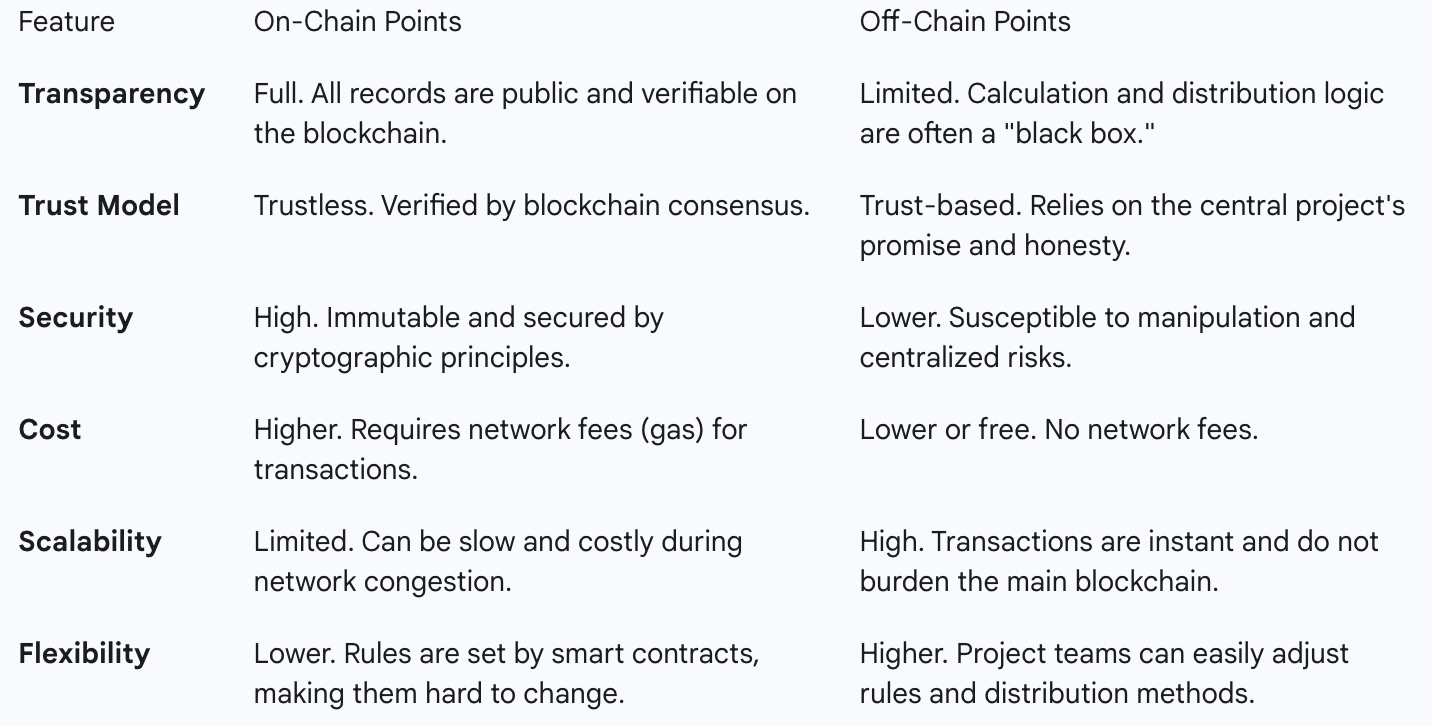

A more recent development is the emergence of on-chain points systems, which are designed to address the centralization paradox. In this model, points are recorded directly on a blockchain, which provides a host of benefits that align more closely with the principles of decentralization.This approach ensures transparency, credibility, and immutability, as all distribution and usage records are publicly auditable and cannot be manipulated.On-chain points also offer the advantage of cross-platform interoperability, allowing them to be transferred or used across different dApps, which is not possible in a closed, off-chain system.The choice between these two models is therefore not just a technical one, but a strategic decision that reflects a project's commitment to the core values of Web3. The continued use of opaque off-chain systems can be seen as a tactical regression to a Web2 model, where the success of a "decentralized" project still relies heavily on trust in a central authority.

To illustrate the key differences, the following table provides a comparison of the operational and philosophical attributes of on-chain and off-chain points systems.

III. The Strategic Imperative: Why Projects Adopt a Points System

The strategic adoption of a points system is a multifaceted decision for a Web3 project, driven by a desire to overcome the limitations of traditional airdrops and build a more resilient ecosystem.

Gamification and Deeper Engagement

Projects use points to gamify their protocols and make user interactions more engaging.By introducing elements like quests, achievements, badges, and leaderboards, projects can create a sense of competition and community, transforming simple transactions into a rewarding experience.For example, a project might reward users with points for completing a profile, following social media, or participating in a hackathon.This game-like structure motivates users to interact more frequently and deeply with the platform, fostering a stronger connection between the project and its community.

A Bridge to Tokens: The "IOU" Strategy

One of the most critical functions of a points system is to act as a bridge to a future token.Instead of launching a token immediately, which risks a massive sell-off, projects can use points to incentivize early adopters with an "IOU" for future tokens.This strategy allows projects to attract users and liquidity at the fragile, early stages of development. It gives the team valuable time to build the network's utility and create "sufficient network value" before the token is released. By delaying the TGE, projects can theoretically ensure a more stable token and a more loyal user base, as the rewards are tied to a sustained contribution over time rather than a single action.

Sybil Resistance and Fairer Distribution

The points system is also a sophisticated tool for combating Sybil attacks and airdrop farming.Sybil attacks involve malicious actors creating multiple fake identities or wallets to gain a disproportionate amount of airdrop rewards.By designing a points system that rewards sustained, multi-faceted engagement over a long period, projects can significantly increase the "cost of forgery" for a Sybil attacker.A farmer must now invest more time, capital, and technical resources to maintain multiple wallets over an extended period to accumulate enough points to be meaningful. This raises the barrier to entry and, in theory, ensures a fairer distribution to genuine, long-term users. However, this is not an impenetrable defense. A sophisticated arms race has emerged, with professional farmers using advanced tools like antidetect browsers, bots, and multiple wallets to automate their activities and bypass these new defenses.This simply shifts the problem from low-effort farming to a more advanced, capital-intensive form of exploitation, which can still dilute the rewards of genuine users.

Community and Governance Building

Points systems can play a crucial role in building a vibrant and engaged community. By offering points for actions such as participating in community discussions or governance initiatives, projects can encourage users to contribute to the project's growth and sustainability.In some cases, points can be tied directly to future governance rights, giving users a tangible stake in the project's future direction and development.This approach helps transform a passive user base into an active, invested community.

IV. The User's Perspective: Benefits and Behavioral Shifts

For many users, participating in a crypto points system offers a low-barrier-to-entry opportunity to accumulate digital assets without significant financial risk.This "earn while you learn" model is particularly appealing to newcomers who are looking to engage with new projects and technologies without a large upfront investment.The quantifiable and transparent nature of points, often displayed on a public leaderboard, also creates a sense of meritocracy and accomplishment.Users can clearly see how their actions contribute to their score, providing a visible and immediate feedback loop that is highly motivating.

Furthermore, referral programs, a common feature of points systems, provide a direct incentive for users to become a project’s biggest advocates.A user can earn a percentage of points from friends they invite, creating a viral growth loop that accelerates adoption.However, this positive feedback loop can also lead to an unhealthy fixation on the points themselves. The speculative promise of a future token can cause users to become overly focused on accumulating points rather than engaging with a project's core utility or technology.In this scenario, the points become the product, and a project’s success is measured by its ability to generate hype rather than its ability to deliver on a meaningful use case.

V. Case Studies: Points Systems in Practice

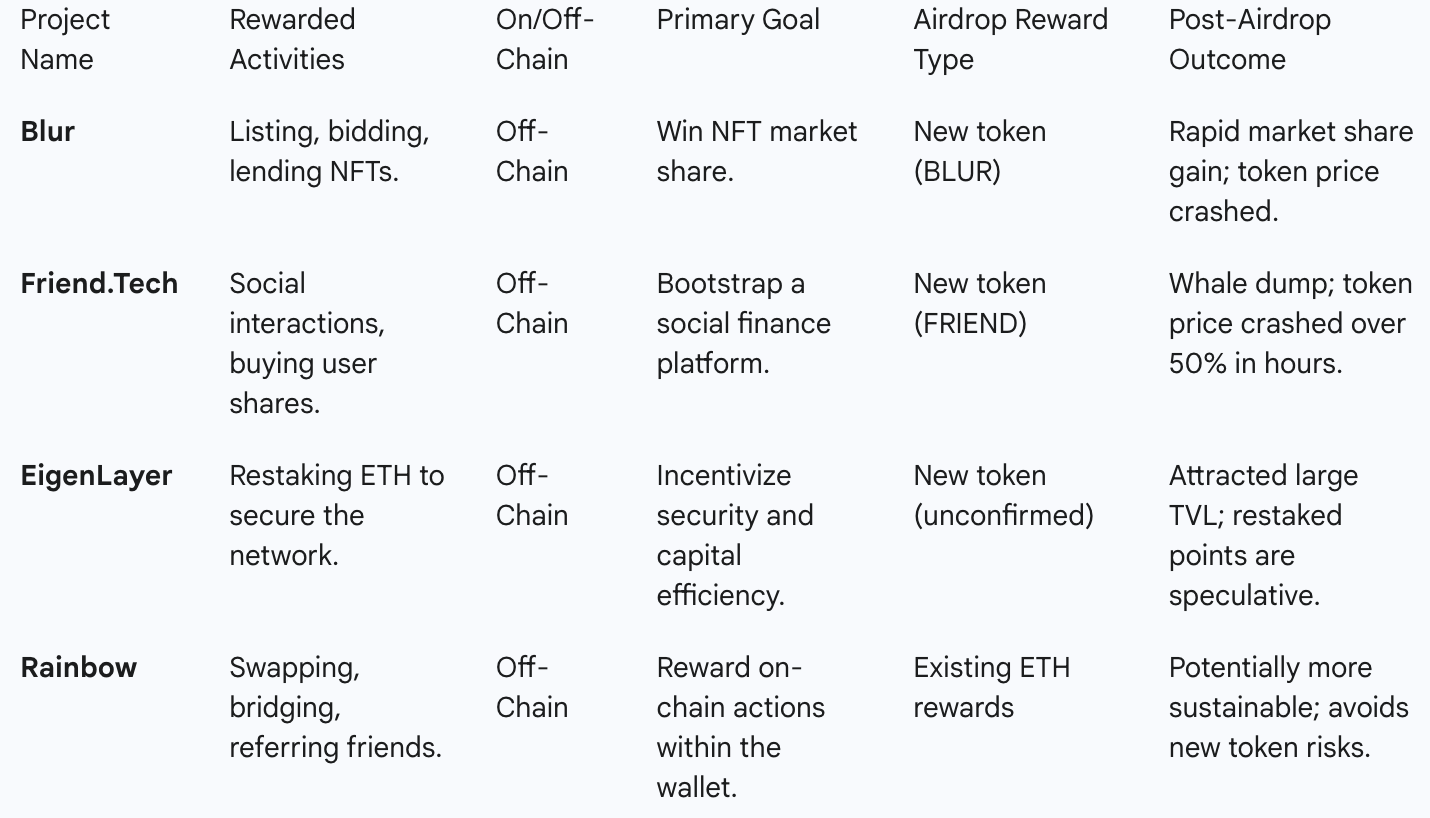

An examination of real-world examples demonstrates the divergent outcomes of points systems and the strategic choices that lead to success or failure.

Blur: The NFT Marketplace Kingmaker

The NFT marketplace Blur used a sophisticated points system to aggressively challenge market leader OpenSea.Blur's airdrop strategy awarded "Loyalty" scores and distributed "Care Packages" of varying rarity to users who listed, bid on, and lent NFTs on its platform.This model was specifically designed to incentivize high-risk behavior and drive deep liquidity, a strategy that paid off handsomely in the short term. By offering zero trading fees and generous points-based rewards, Blur successfully overtook OpenSea in trading volume and captured a significant portion of the market.However, the long-term sustainability of this model remains uncertain. Following its airdrop, the BLUR token experienced extreme price volatility, with its value plummeting by over 90% from its all-time high, a classic example of post-airdrop sell pressure.Blur's case demonstrates that a points system can be a powerful tool for winning a market share battle, but it does not provide an inoculation against the speculative behavior and price instability that often follow a token launch.

Friend.Tech: A Cautionary Tale of Social Finance

The decentralized social networking app Friend.Tech employed an off-chain points system that rewarded users for interactions on its platform with weekly points drops and the promise of a future token.This generated immense speculation and attracted a large user base, but the centralized and opaque nature of its points distribution left it vulnerable to exploitation. The token launch provides a stark example of this risk: a whale farmer, the largest airdrop recipient, immediately sold over 55,000 of the newly issued tokens, causing the price to crash by over 50% in a matter of hours.This incident served as a powerful cautionary tale, highlighting how a lack of transparency and a focus on speculative rewards can be exploited by professional farmers, leading to a catastrophic token launch and a loss of community trust.

EigenLayer & Rainbow: A Divergent Path

Some projects have adopted points systems for more targeted and potentially sustainable purposes. EigenLayer, a restaking protocol, uses "Restaked Points" to reward Ethereum validators for their contributions to network security, a more institutional-focused approach.Rainbow, a crypto wallet, offers a rewards program that grants "Rainbow Points" for on-chain actions like swapping and bridging, but with a key difference: the rewards are distributed as weekly ETH airdrops, not a new, speculative token.The divergence of these models from those of Blur and Friend.Tech is a crucial point of analysis. By rewarding users with a liquid, existing asset like ETH, Rainbow may be creating a more sustainable model that avoids the "points-to-token-dump" cycle entirely, suggesting a path forward for projects that seek to build genuine, long-term communities without succumbing to the inherent risks of launching a new speculative asset.

VI. The Inherent Risks and Criticisms

While the points system has become a dominant incentive model, it is not without significant risks and criticisms.

The Speculation Over Utility Problem: One of the most common critiques is that the system can create a scenario where the accumulation of points becomes the primary objective, overshadowing the actual utility or value of the project itself.This can lead to projects prioritizing hype and speculative interest over developing a robust, long-term use case, ultimately creating a volatile and unsustainable ecosystem.

Regulatory Scrutiny and "Decentralization Theater": The legal and regulatory status of points systems is a growing concern. Regulatory bodies like the SEC may view a project's use of a points system as a method to conduct an unregistered securities offering, especially when the points are a clear precursor to a future token.The SEC has expressed skepticism towards "decentralization theater," where projects claim to be decentralized while maintaining centralized control over key mechanisms, such as an opaque points system.This poses a significant legal risk for projects that do not prioritize transparency and true decentralization.

Centralization and Lack of Transparency: The reliance on off-chain points systems, which are controlled and managed by a central team, stands in direct contrast to the decentralized principles of Web3.This centralization creates a lack of transparency regarding the total supply of points, the distribution schedule, and the eventual conversion rates, all of which can be manipulated by the project's founders. This opaqueness forces users to place trust in a single entity, which is the very problem that blockchain technology was created to solve.

Environmental Impact: While points systems themselves are not energy-intensive, they are often used to incentivize activities on blockchains that utilize Proof-of-Work (PoW) consensus mechanisms, which have a significant environmental footprint.By driving user engagement on these networks, points systems can indirectly contribute to their energy consumption and carbon emissions.

VII. Conclusion: A Path to a Sustainable Points Economy

The crypto points system represents a necessary evolution from the blunt, easily-gamed airdrops of the past. It is a powerful and sophisticated tool for managing network growth, incentivizing community engagement, and strategically controlling market dynamics. However, its effectiveness and long-term viability depend entirely on a project’s design choices and its commitment to the core principles of Web3.

The future of a sustainable points economy will likely involve a clear and decisive shift towards more transparent, on-chain models.By leveraging the immutability and auditability of the blockchain, projects can build points systems that are not just more efficient but also more credible and fair, thereby restoring the trust that the opaque, off-chain model has eroded.

Furthermore, projects must evolve their perspective on points, viewing them not as a final reward but as a mechanism to cultivate a genuine, long-term community. The most successful and resilient projects will be those that tie points to tangible utility, such as governance rights, and find ways to retain users beyond the initial speculative hype.The market has already provided powerful examples of both airdrop successes and catastrophic failures, and as the ecosystem matures, users will become increasingly discerning. The future will belong to projects that prioritize verifiable, long-term value over short-term speculative gains.