Traders expect a new record high before the halving event as Bitcoin’s price accelerates its steep climb, reaching $64,000. Could this be the precursor to setting a new all-time high?

The price of Bitcoin witnessed a significant uptick, escalating over 10% to set a new high for 2024 at $64,000 as of February 28, culminating in a 50% increase in value for the month. This surge is predominantly attributed to the market’s anticipation of the imminent halving event, historically associated with a bullish price trajectory.

Bitcoin recently surged past $60,000 for the first time in two years. This milestone reflects a 13% weekly and a 37% monthly gain, as reported by CoinMarketCap. The previous occasion Bitcoin reached this level was before its significant drop in November 2021, culminating in a low of $19,297 by early April 2022.

The current upward trajectory is largely tied to the anticipation of the upcoming Bitcoin halving event, traditionally associated with a rise in buying due to expected supply cuts, potentially leading to higher prices. Bryan Legend of Hectic Labs views this as the start of a bullish market phase, often referred to as the “Pre-Halving rally.” Conversely, crypto analyst Rekt Capital suggests a potential “pre-halving retracement,” noting that significant market movements typically occur after, not before, halving events.

The introduction of spot Bitcoin exchange-traded funds (ETFs) has also been identified as a crucial factor contributing to the current bullish trend in Bitcoin’s price.

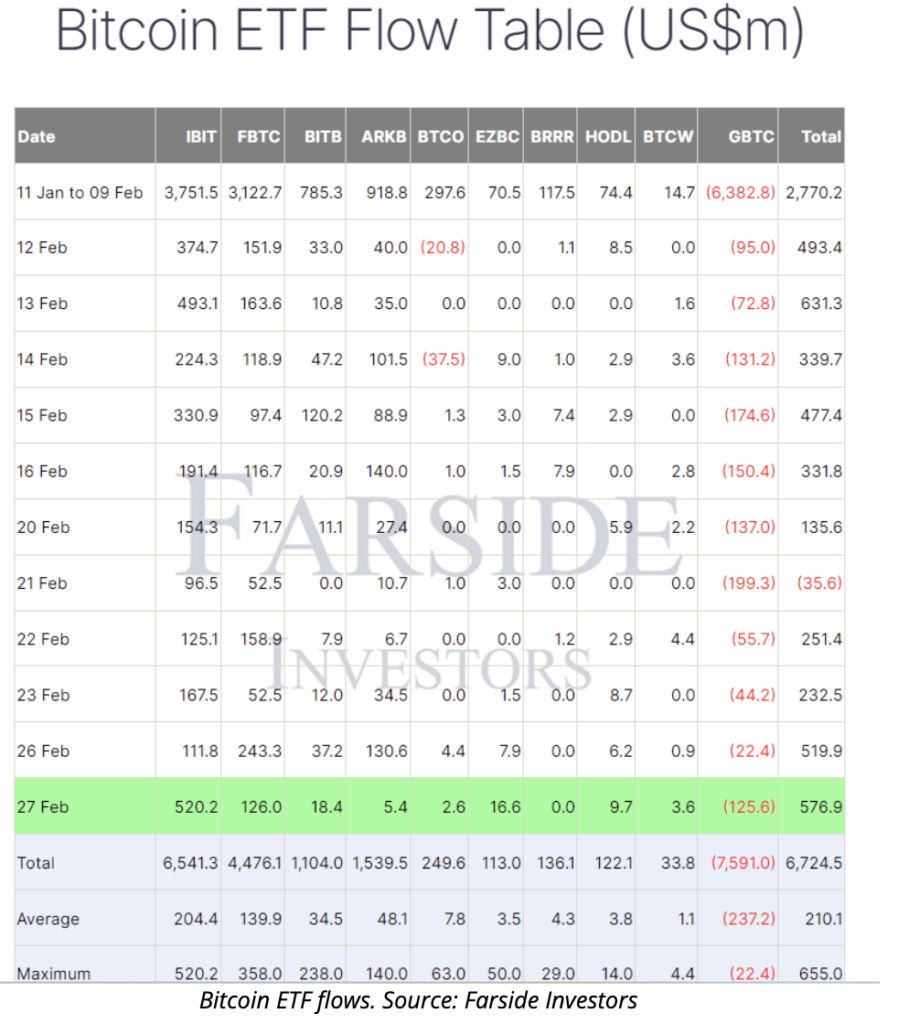

Bitcoin’s upward trend followed the achievement of a record $2.4 billion in daily trading volume by U.S. spot Bitcoin exchange-traded funds (ETFs) on February 26, as reported by Eric Balchunas, a senior ETF analyst at Bloomberg.

Despite the positive momentum, certain market observers have raised concerns regarding the current market structure and the widespread use of high funding rates, suggesting the potential for a correction due to the unwinding of leveraged positions.

On the other hand, options market experts have a more optimistic view, believing in the rally’s durability and dismissing the idea that the surge is nearing its end. Analyst Chris Newhouse highlighted the rally’s characteristics, attributing it to a combination of derivatives market activity and spot market demand, further amplified by record-breaking inflows into ETFs. He noted the significant moment when Bitcoin crossed the $53,000 threshold, underscored by robust trading volumes and authentic demand, which attracted momentum traders to the market.

Nunya Bizniz, an independent market analyst, contributed a positive outlook by emphasizing that Bitcoin’s Relative Strength Index (RSI) exceeding 70 suggests a continued uptrend, a pattern observed to last for a minimum of 335 days after such RSI levels were reached in previous cycles.

In the ETF sphere, spot Bitcoin ETFs in the U.S. have seen unprecedented trading volumes, peaking at $2.4 billion on February 26, with continued high activity following. BlackRock’s iShares Bitcoin Trust ETF notably surpassed 100,000 trades on February 27, a significant jump from its daily average. Spot Bitcoin ETFs are credited with driving 75% of new Bitcoin investments, underscoring their impact on the market’s dynamics.

Was this $64,000 the top of BTC price this season?

Following its peak at $64,000, Bitcoin experienced a sharp decline to $58,700, presumably due to a significant sell-off at that price point, coupled with the liquidation of over-leveraged long positions. However, Bitcoin managed to recover nearly 5% from this dip shortly after.

At present, Bitcoin is merely less than 13% shy of its all-time high of $68,900, with a mix of retail and institutional investors anticipating surpassing this record prior to the halving event, which is slated to occur in approximately 52 days.