Bitcoin has started to recover steadily which has caused a

Bitcoin has started to recover steadily which has caused a pretty smile on everyone’s face now. Whereas many people and bitcoin investors are happy to see Bitcoin recover, there are miners who still seem to be disappointed.

Yes, Bitcoin Mining Difficulty recently witnessed a drop of more than 7% in the last 24 hours, because miners, despite the recent bitcoin recovery that has taken it above $4,000, miners are still finding it daunting to make profits or break even.

According to the sources familiar with the situation, there are several mining operations across Europe and Asia which got shut down due to the ongoing bearish trend. The UK’s largest crypto mining facility, Bladetech, also shut down surprisingly.

Is This Going To Put An End To Bitcoin Mining?

Undoubtedly, the withdrawing miners have caused a significant reduction in the hash rate. Well, the network is perfectly designed to consequently adjust the difficulty level so that there is no backlog when there is huge transaction confirmation backlog. In light of that, it is unlikely that a 7% drop in bitcoin mining difficulty will initiate a similar difficulty pattern.

Image Source: BitInfoCharts

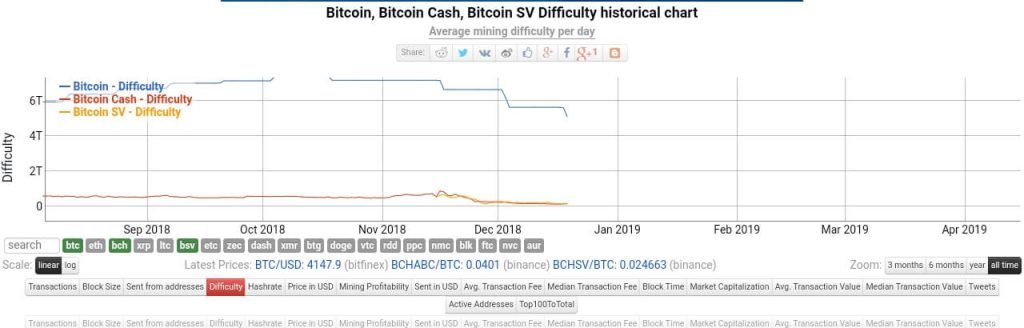

As shown in the chart above, the level of bitcoin mining difficulty witnessed a decline from 5.8TH/s to 5TH/s on 19th December. Whereas, Bitcoin Cash and Bitcoin SV managed to stay stable at 1TH/s.

Image Source: BitInfoCharts

Where the bitcoin mining interest is witnessing a steep decline, it is negatively impacting the mining interest of Bitcoin Cash and Bitcoin SV. Surprisingly, miners are not making any shift from the platforms, but rather bidding goodbye to the crypto mining altogether.

As bitcoin can be seen recovering to above $4000, the difficulty in mining may not create any disruption in its functioning at least for a short term. Also, the dynamic difficulty adjustment system will make sure about the optimum hash power for the network.

Where Does The Real Threat Lie?

What poses as a real threat is that such a market condition will likely be detrimental to the mass adoption of bitcoin in the long run. In case, the miners continue to bid farewell in droves, it can theoretically put a big question mark on the security of the cryptocurrencies.

Well, that may be too early to predict something like that, an upward price movement may put the situation upside-down.