The show-cause notice was sent to Binance, OKX, Kucoin, Kraken and others on December 28 for operating in non compliance and illegally in India due to their non-compliance with the nation’s anti-money laundering laws.

Apple has recently removed the applications associated with three offshore cryptocurrency exchanges – namely Binance, Kucoin, and OKX – from its App Store available in India. This action follows a notice sent by the finance ministry to nine virtual digital asset (VDAs) service providers towards the end of the previous month.

This action followed closely after these international firms were accused of operating “illegally” within the country. The Financial Intelligence Unit (FIU), a government agency responsible for monitoring financial transactions, issued warnings to these nine crypto firms, alleging their non-compliance with India’s anti-money laundering regulations.

Specifically, on December 28, 2023, the Ministry of Electronics and Information Technology (Meity) dispatched show-cause notices to these nine crypto VDAs due to their non-compliance with the nation’s anti-money laundering laws.

The show-cause notice was directed at Binance, Kucoin, Houbi, Kraken, Gate.io, Bittrex, Bitstamp, MEXC Global, and Bitfinex, highlighting their purported illegal operations in India by failing to register and adhere to local tax regulations. As instructed by the finance ministry, the information technology ministry was tasked with blocking the URLs associated with these exchanges.

What Ministry of Electronics and Information Technology (Meity) said

The statement from Meity regarding the blocking of URLs emphasized the directive issued to the information technology ministry to restrict or prevent access to the URLs associated with the flagged cryptocurrency exchanges.

The finance ministry stated that both offshore and onshore Virtual Digital Asset service providers engaged in activities such as facilitating exchanges between virtual digital assets and fiat currencies, managing the transfer of these assets, or offering instruments enabling control over them, are mandated to register with Financial Intelligence Unit-India. Additionally, they are required to adhere to the provisions outlined in the Prevention of Money Laundering Act (PMLA), 2002.

For context, the Financial Intelligence Unit-India functions as the national agency responsible for receiving, analyzing, and sharing information concerning potentially suspicious financial transactions with law enforcement agencies domestically and internationally.

The Ongoing Scenario

As of the current moment, these applications remain accessible on Google’s Play Store. However, there’s a high likelihood that they may also face removal from the Google Play Store, mirroring the actions taken by Apple in removing them from the App Store. This sequence of events emphasizes the heightened scrutiny and regulatory actions imposed on cryptocurrency exchanges in India, signaling a larger regulatory environment seeking compliance and oversight within the country’s crypto market.

In response to the FIU’s concerns, the agency urged India’s Ministry of Information Technology to block access to the websites of these flagged services within India. Alongside Binance and Kraken, other affected exchanges whose applications were removed from the App Store include Huobi, Gate.io, Bittrex, and Bitfinex. Notably, while Bitstamp was identified by the FIU as an offending exchange, its application remained available on the App Store in India. However, the app for OKX, another named exchange, also disappeared from the store.

It’s important to note that despite the removal of these apps from the Apple App Store, they are still accessible through the Google Play Store in India, and their websites remain accessible within the country. Users who had previously installed these applications on their devices can continue using them for now.

The actions by Apple to remove these cryptocurrency exchange apps in response to alleged non-compliance with regulatory norms highlight the ongoing scrutiny and regulatory challenges faced by such platforms in India’s evolving financial landscape.

Apple did not immediately provide a response when approached for comment regarding the removal of cryptocurrency exchange apps from its App Store in India.

Binance South Asia X handle pinned a tweet saying:

The Regulatory Dialeimma

In recent periods, a significant number of Indian traders have shifted towards utilizing global cryptocurrency platforms, seemingly as a means to avoid tax obligations. India introduced taxation on virtual currencies last year, imposing a 30% tax on profits and a 1% deduction on each crypto transaction. While several India-based crypto exchanges, such as CoinSwitch Kuber backed by a16z, CoinDCX backed by B Capital, and WazirX previously partnered with Binance, continue to enforce stringent know-your-customer (KYC) verifications for new user onboarding, many global platforms have not adhered to similar practices. Consequently, WazirX has experienced a substantial 97% drop in trading volume over the span of two years, partly due to the migration of traders to global applications.

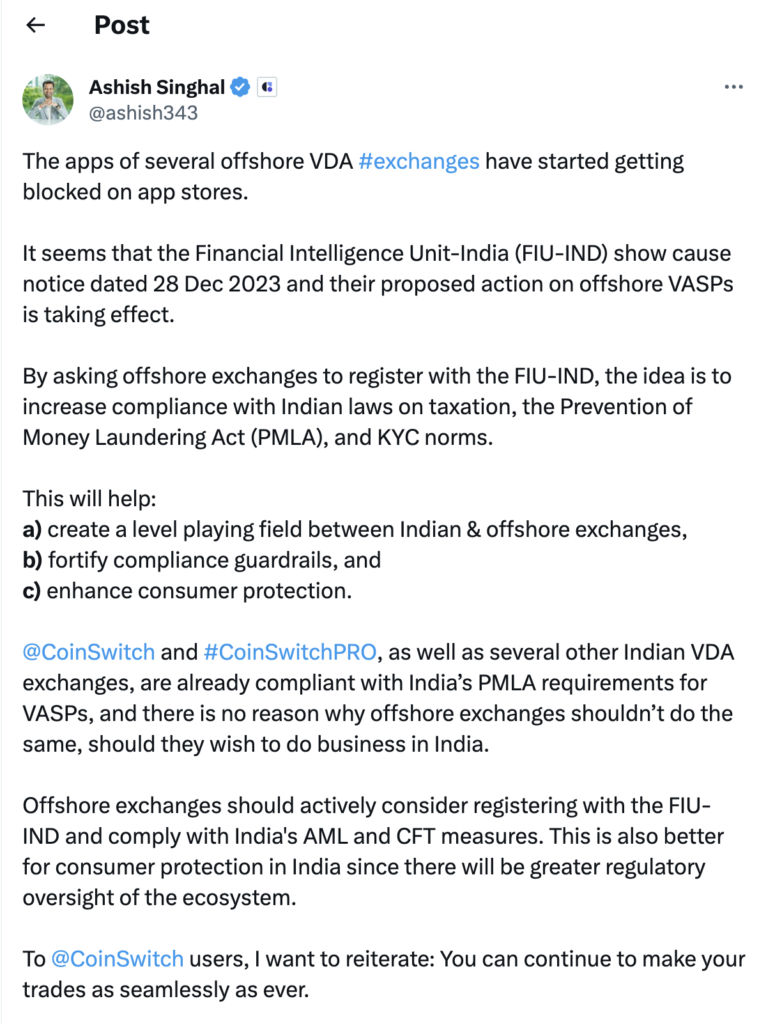

Ashish Singhal, the co-founder and chief executive of CoinSwitch, highlighted that platforms like CoinSwitch and CoinSwitch PRO, among other Indian Virtual Digital Asset (VDA) exchanges, are already in compliance with India’s Prevention of Money Laundering Act (PMLA) requirements for Virtual Asset Service Providers (VASPs). Singhal emphasized the importance of offshore exchanges following suit and meeting these regulatory standards if they intend to conduct business in India. Singhal stressed that offshore exchanges should consider registering with the Financial Intelligence Unit of India (FIU-IND) and adhering to India’s Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) measures. This approach, according to Singhal, would not only benefit consumer protection within India but also ensure greater regulatory oversight within the cryptocurrency ecosystem.

CoinDCX and CoinSwitch Kuber, two prominent Indian cryptocurrency exchanges, had previously warned the New Delhi government regarding the potential consequences of its newly imposed taxation policy on cryptocurrencies. They cautioned that such a policy might prompt users to gravitate towards decentralized exchanges or opt for non-compliant services. Recently, CoinDCX made an announcement stating its intention to incentivize customers who transfer their cryptocurrency holdings from global exchanges to their India-based platform through reward programs.

India has historically maintained a stringent stance toward cryptocurrencies and the entities facilitating their trade. Approximately five years ago, the Reserve Bank of India (RBI) imposed a ban on cryptocurrencies within the country. Although this ban was later overturned by India’s Supreme Court, the RBI has continued advocating for the prohibition of crypto assets. Senior officials within the central bank have even likened these virtual digital assets to Ponzi schemes.

Coinbase, a globally recognized cryptocurrency exchange, halted the onboarding of new customers in India last year. Brian Armstrong, the CEO of Coinbase, alleged in 2022 that the company was facing what he termed as “informal pressure” from India’s central bank. This move by Coinbase illustrates the challenges faced by international exchanges in navigating the regulatory landscape in India, highlighting the complexities and pressures involved in operating within the country’s crypto market.