Ethereum’s price experienced an approximate 6.98% increase, further climbing to an 8.9% rise, reaching $2,080

In this significantly growing era of cryptocurrency, a significant development has emerged, capturing the attention of investors, market analysts, and enthusiasts alike. BlackRock, the world’s largest asset manager, known for its influential role in global finance, has taken a bold step into the realm of digital currencies. This strategic move, centered around Ethereum (ETH), marks a pivotal moment in the intersection of traditional finance and the burgeoning world of cryptocurrencies. With the registration of the iShares Ethereum Trust and the filing for a spot Ether ETF, BlackRock is not just dipping its toes but diving headfirst into the crypto pool. This article delves into the nuances of BlackRock’s Ethereum initiatives, exploring their market impact, the reactions from the crypto community, and the broader implications for the future of digital asset investing.

Introduction to the Context

BlackRock, a global leader in asset management, has recently made significant strides in the cryptocurrency market, focusing on Ethereum (ETH). This analysis delves into the specifics of BlackRock’s Ethereum-related activities, including key industry reactions and the competitive landscape.

BlackRock’s Ethereum Trust Registration

On November 9, 2023, BlackRock registered the iShares Ethereum Trust in Delaware. This strategic move is reminiscent of their earlier approach with Bitcoin, suggesting a deliberate expansion into Ethereum. The registration is a critical first step towards launching a spot Ether Exchange-Traded Fund (ETF).

The iShares Ethereum Trust, a new entity linked to BlackRock, has been officially registered with the Division of Corporations in the state of Delaware. This registration, dated November 9, marks a significant step in BlackRock’s foray into the cryptocurrency domain. The individual listed as the agent for this registration is Daniel Schweiger, whose professional profile on LinkedIn identifies him as a Managing Director at BlackRock. The address provided for this registration corresponds to BlackRock’s location in Wilmington, Delaware. Notably, the name ‘iShares Ethereum Trust’ reflects BlackRock’s branding, as ‘iShares’ is a well-recognized brand under the BlackRock umbrella. This strategic move by BlackRock, involving the establishment of the iShares Ethereum Trust, signifies their expanding interest and investment in the digital currency space, particularly in Ethereum.

Filing for a Spot Ethereum ETF

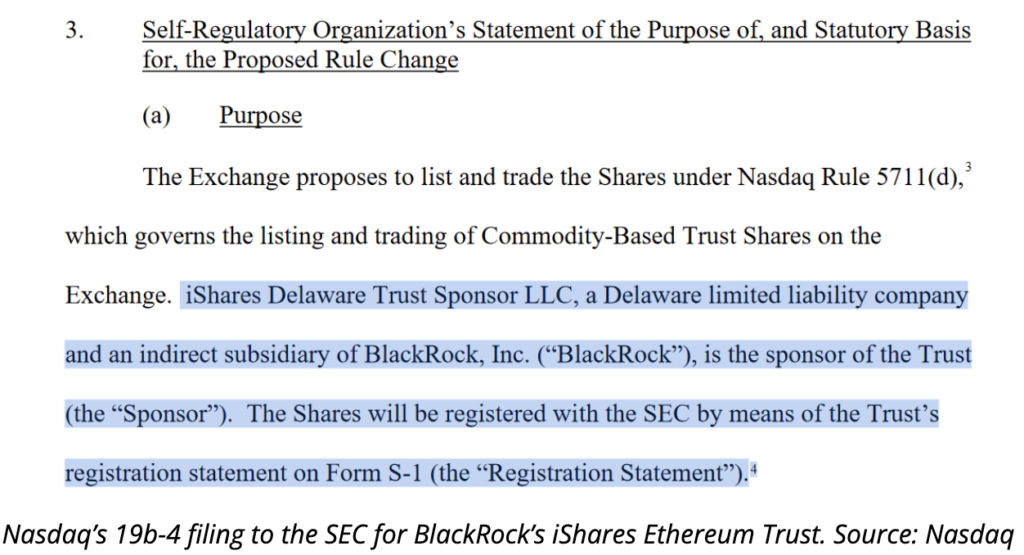

Confirming its interest in Ethereum, BlackRock filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) for a spot Ether ETF, named “iShares Ethereum Trust.” This filing represents a significant shift in BlackRock’s focus, extending beyond Bitcoin to embrace Ethereum.

Market Impact and Ethereum’s Price Surge

The announcement of BlackRock’s Ethereum ETF filing catalyzed a bullish response in the crypto market. Ethereum’s price notably surged past the $2,000 threshold, a significant psychological barrier. This price movement not only underscored Ethereum’s market potential but also influenced the broader altcoin market, introducing a degree of volatility.

Specific Market Changes

- Ethereum’s price experienced an approximate 6.98% increase, further climbing to an 8.9% rise, reaching $2,080.

- Ethereum’s market dominance improved by 1.3 percentage points, reaching 17%.

Industry Reactions and Competitive Landscape

- Twitter Commentary: Prominent figures like Udi Wertheimer and Raoul Pal commented on the development. Wertheimer humorously referred to BlackRock’s move as acknowledging that “there is a second best,” while Pal highlighted the potential of an ETH ETF as a “holy grail for asset managers.”

- Competitive ETF Filings: Other financial firms, including VanEck, ARK 21Shares, Invesco, Grayscale, and Hashdex, have also filed for spot ETH ETFs. These filings indicate a growing competitive landscape in the cryptocurrency ETF market.

Regulatory Considerations and Future Outlook

Despite the market enthusiasm, the regulatory landscape remains a significant factor. The SEC’s history of hesitance in approving Bitcoin ETFs suggests a cautious approach towards Ethereum ETFs. However, BlackRock’s involvement is a noteworthy development, potentially influencing future regulatory decisions and the investment landscape for digital assets.

The landscape of applications for spot Ethereum (ETH) Exchange-Traded Funds (ETFs) with the U.S. Securities and Exchange Commission (SEC) has been quite dynamic, though none have received approval so far. A significant number of financial institutions have shown interest in launching their own ETH ETFs. Notably, the SEC postponed its decision on applications from ARK 21Shares and VanEck, which were initially reviewed on September 27. The final decisions on these applications are anticipated around December 25 or 26. Following these, other financial entities like Invesco and Galaxy Digital also submitted their applications for spot ETH ETFs. In a similar vein, Grayscale, known for its Grayscale Ethereum Trust, made a move in October to transform this trust into a spot ETF.

In a parallel development, on November 9, ARK Invest in collaboration with 21Shares, unveiled their plans to introduce a new range of digital asset ETFs. These ETFs are designed to invest in long-term futures contracts for both Bitcoin (BTC) and Ethereum (ETH), indicating a growing interest in diversified cryptocurrency investment vehicles.

Amidst these developments, BlackRock, recognized as the world’s largest asset manager with an impressive $9 trillion in assets under management, has also been a key player. The firm’s application for a spot Bitcoin ETF is currently under the SEC’s review. This involvement of BlackRock in the cryptocurrency ETF space, particularly with its substantial assets under management, underscores the increasing interest and potential growth of cryptocurrency investments in mainstream financial markets.

To Summarise

BlackRock’s foray into Ethereum, highlighted by the registration of the iShares Ethereum Trust and the subsequent ETF filing, is a pivotal event in the cryptocurrency industry. It not only demonstrates the growing institutional interest in digital currencies but also suggests a potential shift in the regulatory and investment landscape. The reactions from industry experts and the competitive response from other financial firms underscore the significance of BlackRock’s actions in shaping the future trajectory of Ethereum and the broader digital asset market.