Mergers and Acquisitions in any nascent space is indicative that

Mergers and Acquisitions in any nascent space is indicative that it’s maturing through consolidations within it. The blockchain-crypto space is no different with at least 300 deals taking place so far.

During the month of April 2019, three noteworthy M&A deals have taken place according to InWara’s Monthly Report: April 2019.

1. Bakkt Acquires DACC

Bakkt-the still pending Bitcoin futures exchange has acquired DACC or Digital Assets Custody Company. According to the COO of Bakkt- Adam White, the acquisition was made to ensure the optimal development of a secure digital asset storage solution. Interestingly, this acquisition might also help Bakkt add altcoins to its platform in the future.

You’ve probably heard of Bakkt’s parent company Intercontinental Exchange (ICE), the same company behind the development of the New York Stock Exchange. The history and experience of advancing global commodities markets that ICE i.e. Bakkt brings to the table has helped the company gain popularity even outside the crypto space.

Earlier Bakkt had bought certain assets of Chicago based Futures commission merchant Rosenthal Collins Group (RCG) according to InWara’s M&A database.

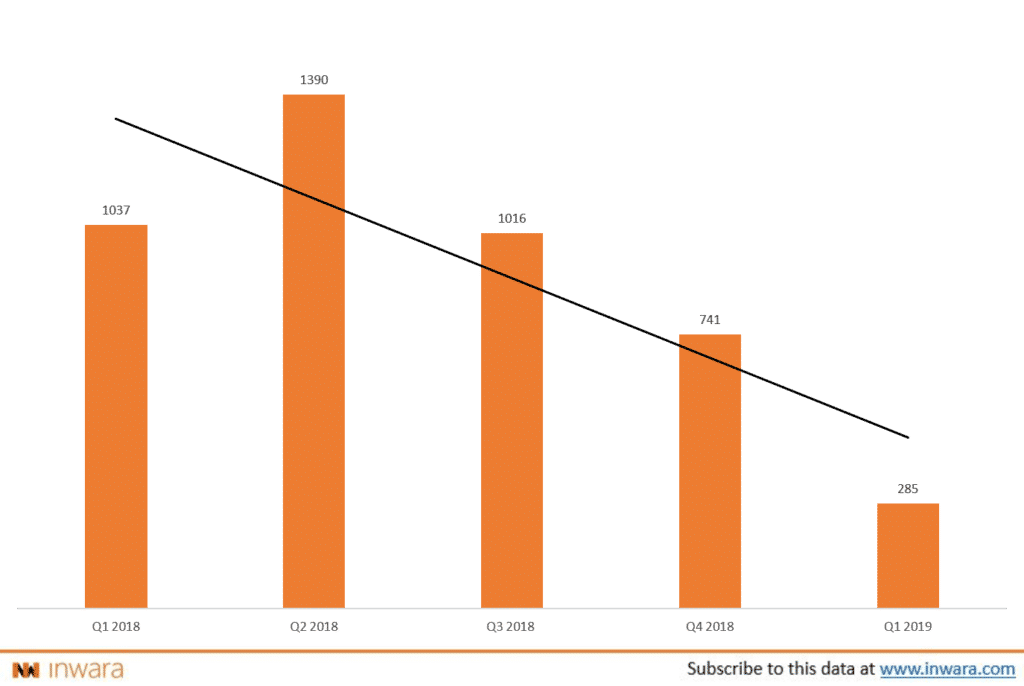

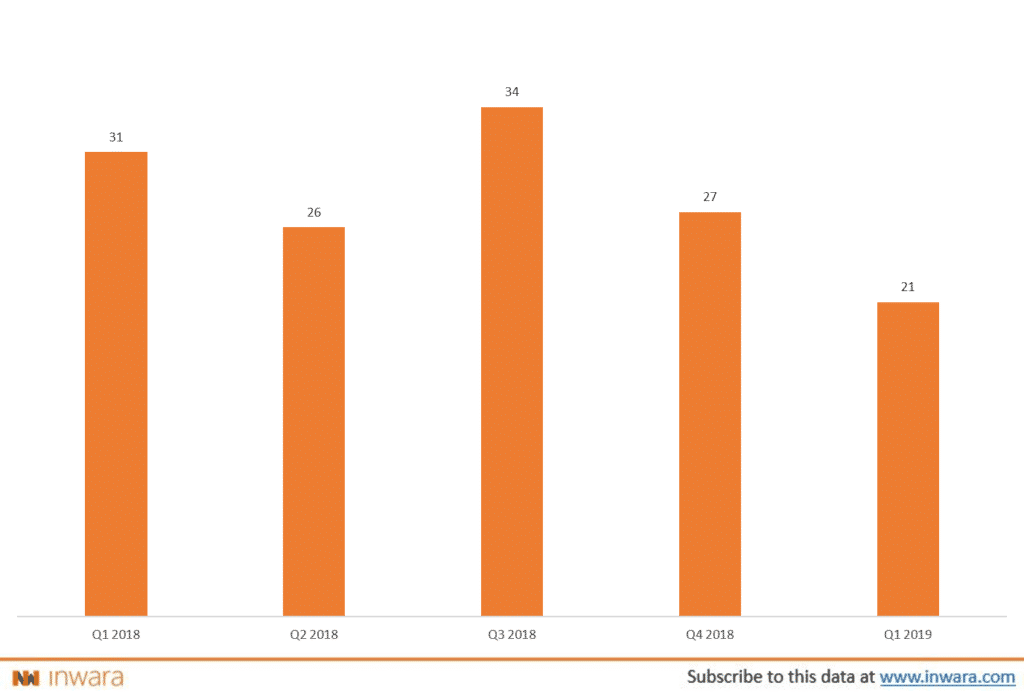

Interestingly, there has been a significant number of M&A deals taking place in the crypto space after the onset of the so-called crypto winter.

M&A Deals by Quarter

During the year 2018, as much as 118 M&A deals took place. But a year earlier, it was as low as 62, according to InWara’s M&A database.

2. Stake Capital Acquires Hotstake

Stake capital acquires staking service Hotstake-a digital assets management company that helps clients earn a passive income by leveraging digital assets. Stake Capital offers investors non-custodial staking services on various networks.

Supporting networks of stake Capital platform include leading platforms like Decred, Cosmos, Livepeer and Loom. Notably, it also supports Tezos.

3. LiveRamp Acquires Faktor

LiveRamp has acquired consent and identity management platform- Faktor. The deal is believed to have a profound strategic impact on LiveRamp’s focus on privacy and data ownership.

LiveRamp’s IdentityLink is a service that helps connect people, data and devices across the digital and physical worlds.