The market has been witnessing turbulent times since the last

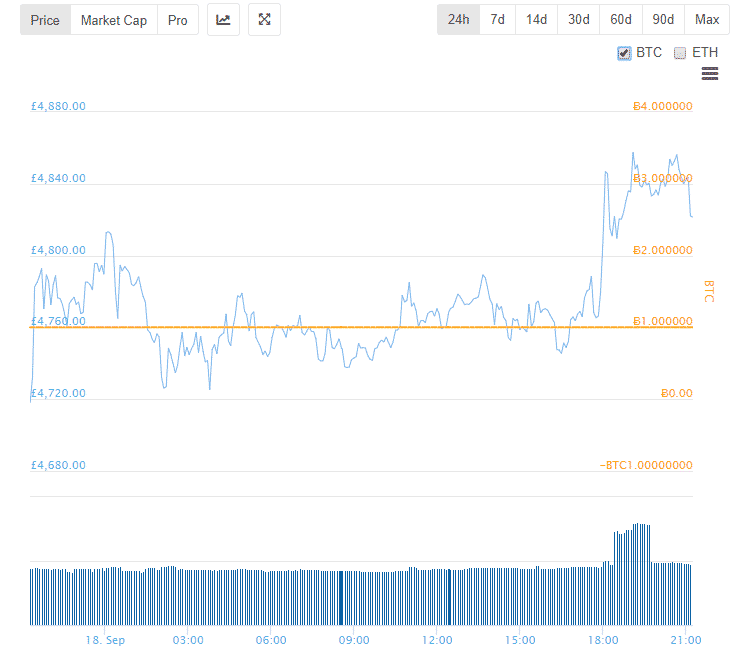

The market has been witnessing turbulent times since the last couple of days. The stocks are volatile and subject to frequent ups and downs. As of now, the market is currently bearish with most of the top cryptos in the red. Bitcoin has dipped to a low of $6342, post its short lived rise to $6,484 early morning, according to British Press Time. It has however gone up by 2.2% in the last twenty four hours.

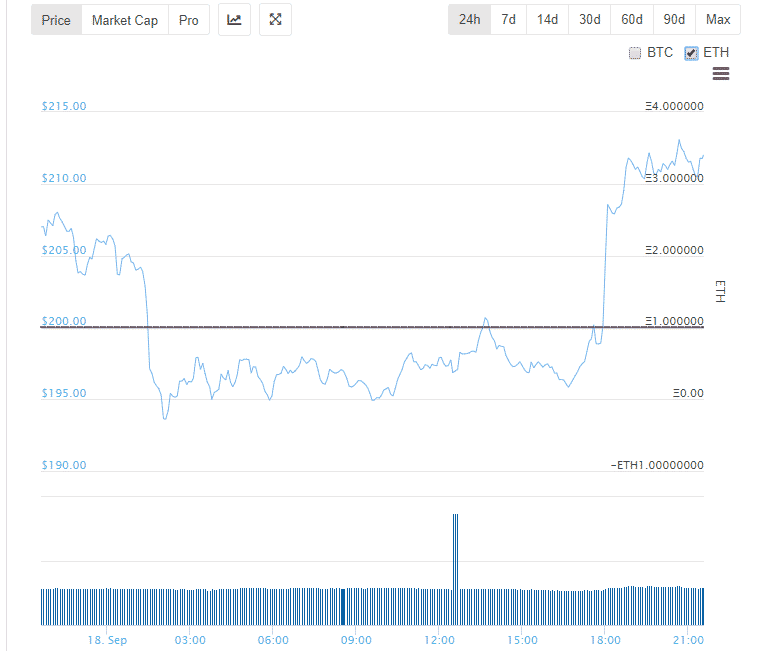

Ethereum has had a sufficiently interesting week. It has demonstrated a growth of 2.4% in the last 24 hours after it’s major intraweek dip to $170 . Since late night of September 12, Ethereum has been dominating the crypto scene by rebounding quickly back. It is possibly the only prominent crypto to show a bullish pattern over the last couple of days.

Now the market has been aptly compared to an ocean which witnesses a lot of big sharks and small fishes in terms of investors. The real big players are the institutional investors who are the bitcoin whales. Their motive always remains to buy low and sell high and they frequently manipulate the market with their pump and dump tactics. There has been a lot of talk in recent times about how the market is being moved by bitcoin whales.

This trend is quite evidently the primary reason behind the volatility of the crypto market. These investors usually have hundreds and thousands of bitcoins at their disposal. These bitcoins can very easily be played around with in the market to cause some serious shifts in prices. There is speculation about Mt. Gox‘s involvement in a huge bitcoin whale movement that might crash the market.

The total market capitalization has fluctuated minutely but is currently showing an upward trend. Stay tuned to find out more about how whales manipulate the market with their pump and dump strategies.