On Friday morning, Nov 9, BTC is very quiet after

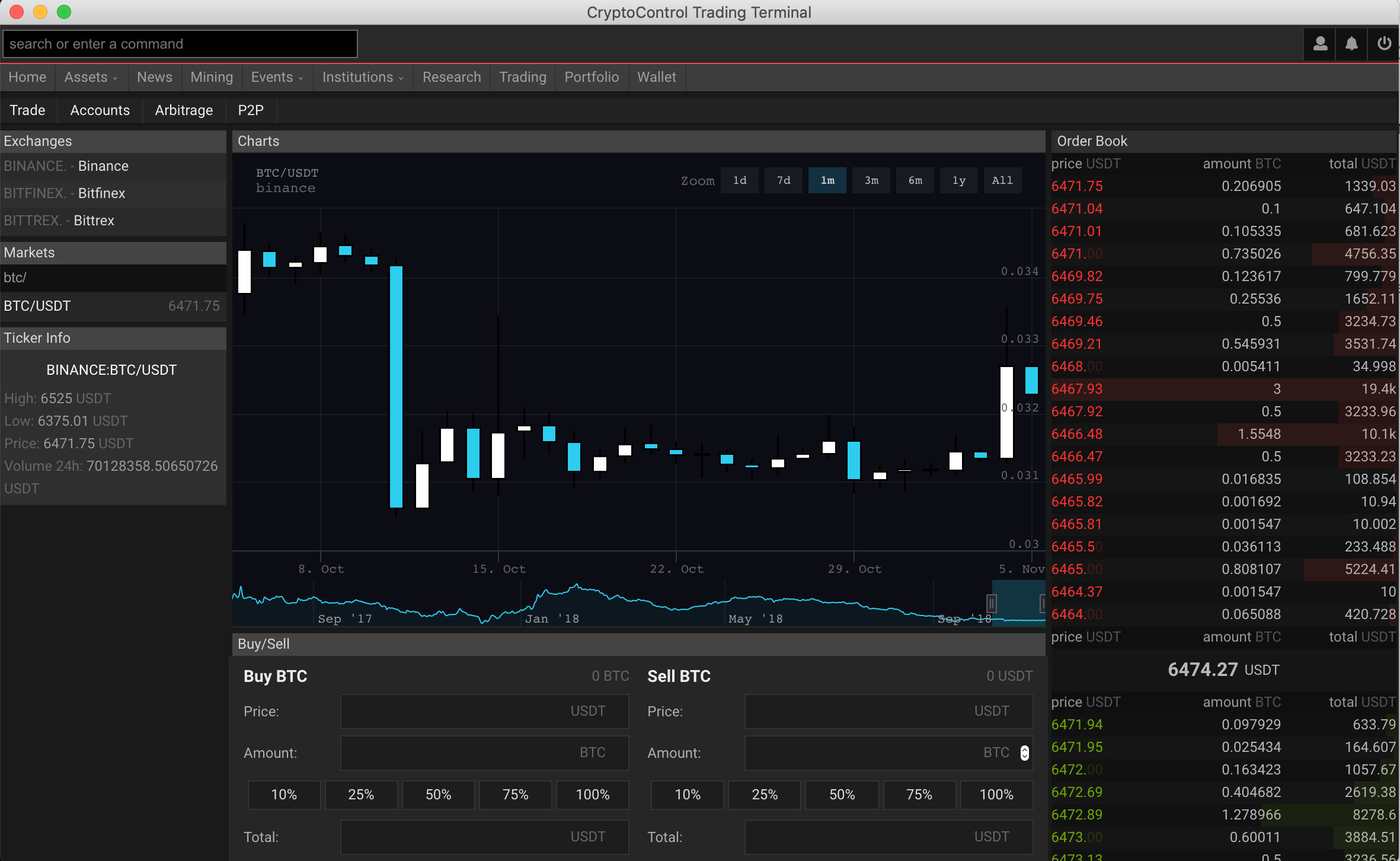

On Friday morning, Nov 9, BTC is very quiet after yesterday’s fall and is trading around $6,488.80, says Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

On H1, the major crypto broke out the latest uptrend support and went down to the target projection channel support. Meanwhile, the downtrend sped up a few times and reached 61.80% Fibo. In the short term, the price may pull back to the resistance at $6,375, and then another downward wave may take BTC to 76% Fibo, or $6,286. When the correction is over, the new rising impulse will push the crypto to the major resistance at $6,414.50.

According to Morgan Stanley, global institutional investors are finding themselves more and more involved into the crypto market (a ‘pot of gold’, as Morgan Stanley call it), while retail traders are gradually losing interest.

By institutional investors, the company most likely means large global banks, hedge funds, investment companies, and other similar institutions. The analysts are sure that, as long as the number of such investors is going up, the likelihood of a revolution in the traditional financial system increases, too.

This is a likely story, as since 2016, the overall investment amount into crypto assets has grown to $7.11B. Bitcoin is the most popular among such assets. In general, it is considered a speculation instrument, although some investors treat it as a tool for savings. This is what BTC may really become in the future. However, before becoming an asset for savings, Bitcoin has to resolve the scalability issue.

Besides, high volatility prevents BTC from becoming a practical tool, too. Finally, privacy is also an issue, although not that critical in the current scenario.

Disclaimer

Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.